Blockchain as solution?

Advantages of Blockchain in Accounting 🚀

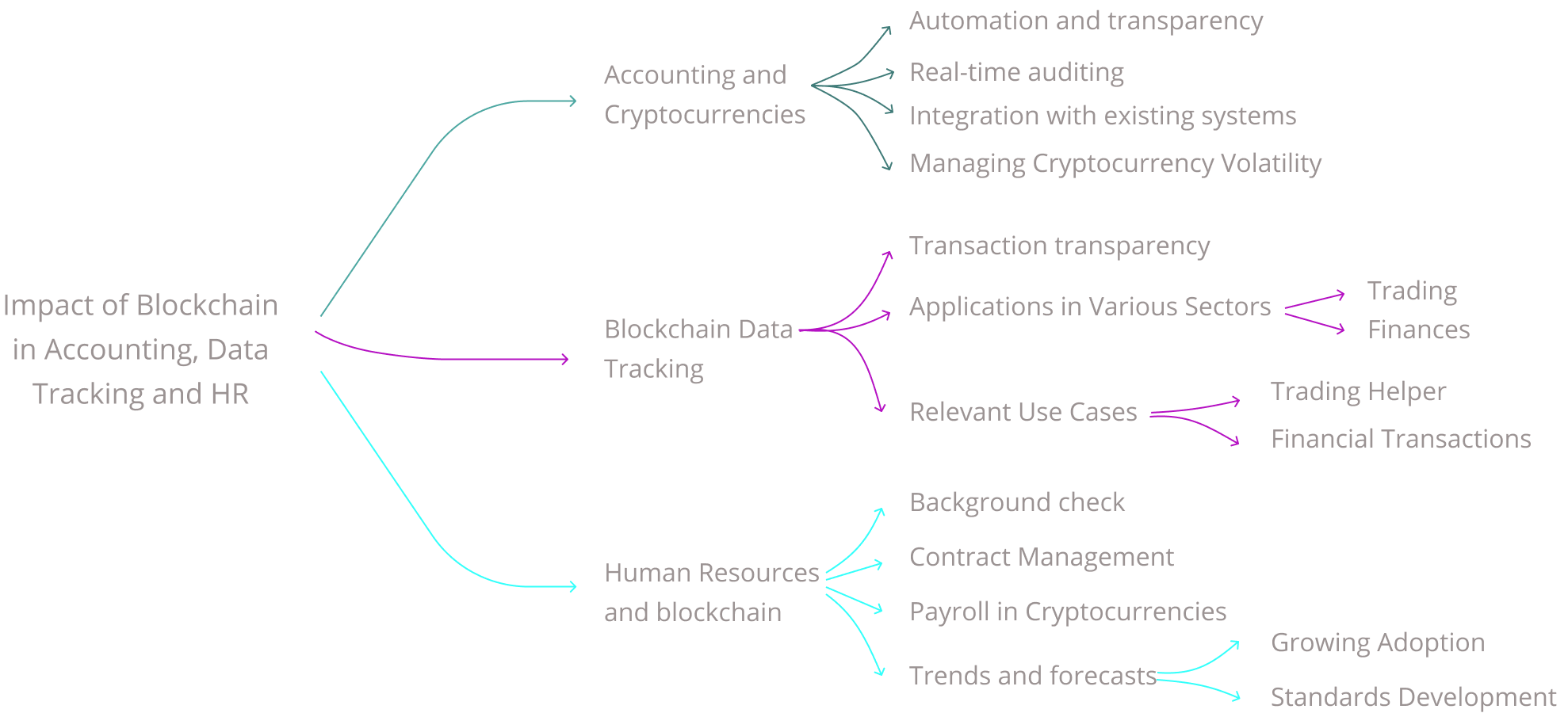

- Error Reduction: Automation through blockchain* can significantly reduce the occurrence of data entry and reconciliation* errors. For example, Deltec Bank & Trust implemented a blockchain system that decreased its data entry errors by 30%.

- Transparency: The transparent nature of blockchain technology aids in preventing fraud and intentional misreporting. Chainalysis Inc., for instance, uses blockchain to enhance transparency in transaction monitoring.

- Security Enhancement: Enhanced security features of blockchain protect sensitive financial information against cyber threats. CipherTrace has developed blockchain solutions that bolster financial security.

Challenges with Blockchain in Accounting ⚠️

- Lack of User-Friendly Software: The absence of dedicated, easy-to-use software for blockchain-based accounting and HR is a major hurdle. QuickBooks Blockchain is an emerging solution.

- Handling Multiple Currencies: Cryptocurrency accounting involves navigating the volatility and transaction fees of multiple currencies. Binance faced challenges when integrating traditional accounting standards with cryptocurrency transactions.

- Currency Conversion: Converting from cryptocurrency to fiat currency adds layers of complexity. Coinbase experienced these challenges during its early adoption of blockchain for accounting purposes.

- NFT Accounting: Accounting for NFTs*, particularly those representing unique assets like real estate, poses challenges. OpenSea has been pioneering methods to address these.

- Taxation Issues: The evolving tax regulations and diverse jurisdictional rules on cryptocurrencies add to the complexity. KPMG's Cryptoasset Services is designed to help navigate this landscape.

In conclusion, while blockchain presents transformative opportunities for accounting, staying abreast of evolving standards and regulations is crucial. Utilizing specialized accounting software, along with ongoing education and adaptation, can help navigate these unique challenges, ensuring regulatory compliance and financial transparency.

Learn more about blockchain in accounting

Blockchain: A digital ledger technology known for its decentralization, immutability, and transparency, commonly associated with cryptocurrencies like Bitcoin.

Reconciliation: The process of ensuring that two sets of records (usually the balances of two accounts) are in agreement. Reconciliation is used to ensure that the money leaving an account matches the actual money spent.

NFTs: Non-Fungible Tokens, digital assets representing real-world objects like art, music, in-game items, and videos. They are bought and sold online, frequently with cryptocurrency, and are generally encoded with the same underlying software as many cryptocurrencies.

Why

Why is meticulous accounting crucial? Imagine a scenario where a tiny, overlooked error cascades into a financial catastrophe, undermining a company's integrity and stability. In the realm of accounting, challenges or errors—whether unintentional or deliberate—often lead to financial discrepancies and mismanagement. These errors, sometimes minor but potentially perilous, can significantly impact a company's financial health, regulatory compliance, and reputation.

What's the Solution?

Facing the complexities of blockchain in accounting, businesses often ponder whether to invest substantial sums in dedicated companies with expertise in both accounting and cryptocurrencies*. While this traditional approach offers expertise, it also means relying on third-party services and trusting them with sensitive data. This not only consumes considerable time but also raises questions about data security and autonomy. So, what's the alternative?